January 13, 2026

Tickets and Sponsorships Are Now Available for the 2026 Annual Gala: Progress and Possibility

Progress and Possibility Thursday, March 26, 2026 6:00 – 9:00pm | Reception and Program UMass…

December 8, 2025

Advocate: The December 2025 Issue Is Now Online

The latest issue of The Arc's Advocate magazine is now available to read online. This issue features:…

October 23, 2025

Operation House Call: 15 Years with The Arc of Massachusetts – Celebrating Growth, Leadership, and the Power of Families as Educators

On October 22, The Arc of Massachusetts and Operation House Call (OHC) celebrated 15 years…

January 29, 2025

RELEASE: The Arc of Massachusetts Receives Autism Community Impact Grant from Doug Flutie, Jr. Foundation for Autism for $10,000

WALTHAM (January 29, 2025): The Arc of Massachusetts, the Waltham-based disability advocacy nonprofit, is pleased…

December 6, 2024

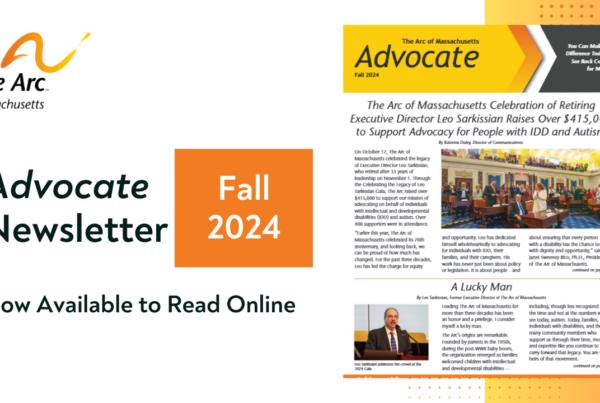

Advocate: The Fall 2024 Issue Is Now Online

The Fall 2024 issue of our print newsletter Advocate is now available to read online. Highlights of…

November 25, 2024

The Arc of Massachusetts Board of Directors Hosts Welcome Reception for New CEO Maura Sullivan

On Thursday, November 21, The Arc of Massachusetts Board of Directors hosted a Welcome Reception…

November 2, 2024

Massachusetts Is the Heart of Advocacy for People with Intellectual and Developmental Disabilities

On November 1, 2024, The Arc of Massachusetts had the distinct honor of having both…